Latest Stories

Recent Stories

(StatePoint) Thanks to content being delivered nonstop over social media channels such as TikTok, YouTube and Instagram, financial advice is more accessible than ever before. The bad news? Much of it can be misinformation.

(StatePoint) Identity theft is on the rise nationwide. In fact, consumers reported losing more than $12.5 billion to fraud in 2024, representing a 25% increase over the prior year, according to recent data from the Federal Trade Commission.

(StatePoint) If you’re like many young adults, you’re turning to social media and online influencers for money advice.

(BPT) - Are you currently a freelancer or gig worker, or thinking about becoming self-employed? If so, you know that being self-employed means enjoying more freedom and autonomy, but also involves missing out on getting a benefits package from an employer. To help you better manage your fina…

(StatePoint) Two in five U.S. adults identify as family caregivers, but there is a lack of support for them nationwide, according to new research from Edward Jones in partnership with Morning Consult and Age Wave. With 46% of Americans expected to become caregivers in the future, this resear…

(BPT) - Blending performance with purpose, this apparel brand forges a powerful connection between water, community and collaboration.

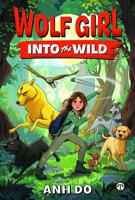

(NAPSI)—Into The Wild by Anh Do—comedian, artist, internationally best-selling Australian author with over a million copies sold—is the first book in the Wolf Girl series, a thrilling new middle-grades trilogy about a young girl who has to learn how to survive with only her new canine found …

Sorry, but your browser does not support the video tag.

(BPT) - Read on for the ultimate checklist for students heading off to college and their families, including graduation celebrations, paperwork, moving and paying for school. Visit CollegeAve.com for more information.

(BPT) - On America's financial scorecard, people rate their happiness with their overall personal finances a 4.97 out of 10 — and scores need improvement across the board, as the majority (91%) are prioritizing their financial health and happiness in a year of decisions ahead. New Empower re…

Turn common small business expenses into rewards

(BPT) - The number of business-savvy mothers blazing the trail as entrepreneurs is at a record high. "Mompreneurs" are transforming the business landscape, not just for themselves, but also for future generations. According to Wells Fargo, growth in the number of female business owners has o…

(NAPSI)—As National Small Business Week (May 4–10, 2025) celebrates the hardworking businesses that fuel communities, two small business success stories—Merlin Complete Auto Care and Nielsen Enterprises—highlight how financing solutions from Synchrony help their customers say “yes” to import…

Sorry, but your browser does not support the video tag.

(NAPSI)—Planning for retirement can feel daunting. However, no matter your age, taking small steps today can better set you up for retirement in the long run. If you’re in your Pretirement years — your 40s and 50s and closer to retirement than the start of your career — it’s all the more imp…

(NewsUSA) - Demand for apartments is at a record high, with renters signing new leases and renewing their existing stays in droves. Residents’ expectations have also increased as they want their renting experience to be as seamless as the rest of their online life. That means integrated tech…

(BPT) - It's never too early, or too late, to establish good money habits with children. Teaching kids about money, including saving, spending and budgeting, can develop financial literacy, which in turn develops responsibility and decision-making skills while establishing the foundation for…

(Family Features) Financial literacy is a critical skill that helps set the foundation for a stable and prosperous future. By understanding the basics of money management, teens can make informed decisions and avoid common financial pitfalls.

(NAPSI)—This year is the 55th anniversary of Earth Day—an excellent reason to consider ways you can make a difference, not just for the environment, but for yourself, your home, and your family.

(Family Features) Tax refunds have started rolling in, which means many people are looking to use this influx of cash to make purchases they’ve been putting off. According to an Oxford Economics report, the amount of money received from income tax refunds this year could be among the highest…

(NAPSI)—Weather is more unpredictable than ever before, and homeowners should take stock of the outdoor power equipment they have in their garages and sheds to handle ensuing damage left behind. Preparation is key—before a storm and unseasonable weather hits a community.

Sorry, but your browser does not support the video tag.

(BPT) - Imposter scams are at an all-time high. These scammers may call, text or email an individual to convince them that the caller is someone in authority to commit identity theft, get people to send money or share personal information. Here are do's and don'ts to best protect yourself.

(StatePoint) Is mounting debt causing you stress? If so, you’re not alone. Average consumer debt is on the rise in the United States.

Sorry, but your browser does not support the video tag.

(StatePoint) Each year, a majority of American parents of college students are confronted with higher-than-expected costs for tuition and room and board, according to a College Ave survey. The same survey finds that the price tag on other college-related expenses, such as books, activity fee…

(BPT) - Tax season is more than just a deadline. It's an opportunity to take control of your finances and plan for the future.

(StatePoint) If you’ve been watching your wallet, you’re not alone. As Americans continue to navigate inflation, 76% report cutting back on spending, up from 67% in 2024, according to the second annual Wells Fargo Money Study.

(NAPSI)—Beware: The person on the other end of that digital communication might not be who they claim to be.

(StatePoint) With flowers blooming and birds chirping, you may be in a spring-cleaning mindset. As you spruce up your home, you can also channel that energy into getting your finances in tip-top shape!

(NAPSI)—A recent public opinion survey commissioned by Stellantis, maker of Chrysler, Dodge, Jeep, and Ram, found that 43% of vehicle owners don’t know how to check their vehicles for safety recalls. For drivers who own new cars and trucks and who get regular updates from their dealerships, …

(BPT) - Do you find yourself putting on an extra sweater or pair of wool socks to avoid turning up the thermostat and increasing your utility bill? According to the U.S. Department of Energy, up to 10% per year in heating and cooling costs can be saved with thermostat regulation. But you sho…

(StatePoint) One of the most important steps to take while house hunting is to create an intentional budget that accounts for both upfront costs and recurring expenses. Doing so will help you find a home that meets both your lifestyle needs and financial situation. Here’s how:

(StatePoint) Receiving a tax refund this year? While it can be tempting to impulse spend, if you want to really treat yourself, financial professionals recommend using the payout for practical expenses.

(StatePoint) Issues around money can put a strain on any couple. However, financial experts say that a strong relationship can be cultivated with financial habits that prioritize communication and shared values.

(StatePoint) The days of filing paper tax returns are gone, and criminals are taking advantage. With taxpayers managing their sensitive information online, thieves are finding new ways to scam victims. In 2023 alone, the IRS reported $5.5 billion lost to tax fraud schemes. And the increased …

(StatePoint) It’s common to wonder how a new presidential administration will impact your wallet. As policies and regulations change, many people are left questioning what it means for their money.

(StatePoint) With the increased use of digital tools, the mortgage process looks quite different today than it did for previous generations. These new technologies can make the home loan process more efficient for both those buying a home and those refinancing their mortgage. However, it’s i…

(StatePoint) On the first day of Christmas, holiday gift giving begins with the traditional gift of a Partridge in a Pear Tree. By the first day of January, True Love pays the bill.

(StatePoint) January is a time for setting goals, new habits and fresh starts.

(StatePoint) Ensuring that financial service providers reflect the diversity of the people they serve is key to creating an inclusive financial system that offers everyone a chance to thrive. That’s according to the authors of a new report.

(StatePoint) Although fraudsters will prey on anyone, many tactics specifically target those facing financial hardship in the wake of a natural disaster.

(StatePoint) The holiday season may be warm, merry and bright, but it’s also a time when it’s all too easy to spend more than you plan to and rack up debt you can’t manage.

(StatePoint) Advertisement. National Hispanic Heritage Month, celebrated from September 15 to October 15, recognizes the contributions Hispanic Americans make to U.S. culture and success. According to advocates, it’s also an annual opportunity to address the gaps that limit their economic security.

(StatePoint) Life is full of changes, transitions, growth—and sometimes disruptions. September is Life Insurance Awareness Month, making it the perfect time to consider a universal life insurance policy that offers flexibility and options catered to your needs.

(StatePoint) Nearly one-third of U.S. homes are at a high risk of damage from a natural disaster, according to CoreLogic.

(StatePoint) Working with a financial advisor can help you reach your short- and long-term financial goals. But it’s all about partnering with the right person, with the right credentials.

(StatePoint) Upfront and ongoing renting costs can put financial stress on any monthly budget. But whether you are experiencing financial hardship or just need a little extra help to make ends meet, you may have options by working with your property manager.

(StatePoint) Scammers are getting better at what they do all the time. According to the Data Book, Americans reported losing $10 billion to scams in 2023, a full $1 billion more than in 2022. While anyone can be a victim, elderly people are often targeted, as they are presumed to have more savings.

(StatePoint) Your credit score plays a significant role in your ability to reach your financial goals.