The American dream of homeownership often begins with a starter home—a manageable property that allows young adults and families to establish roots, build equity, and lay the groundwork for financial security. This initial step on the property ladder fuels the housing market and strengthens the economy by creating a generation of invested homeowners. However, finding an affordable starter home has become increasingly challenging in recent times. With historically low levels of inventory at entry price points, homeownership in the U.S. has become an uphill battle.

Changes in Home Prices & Household Income Over Time

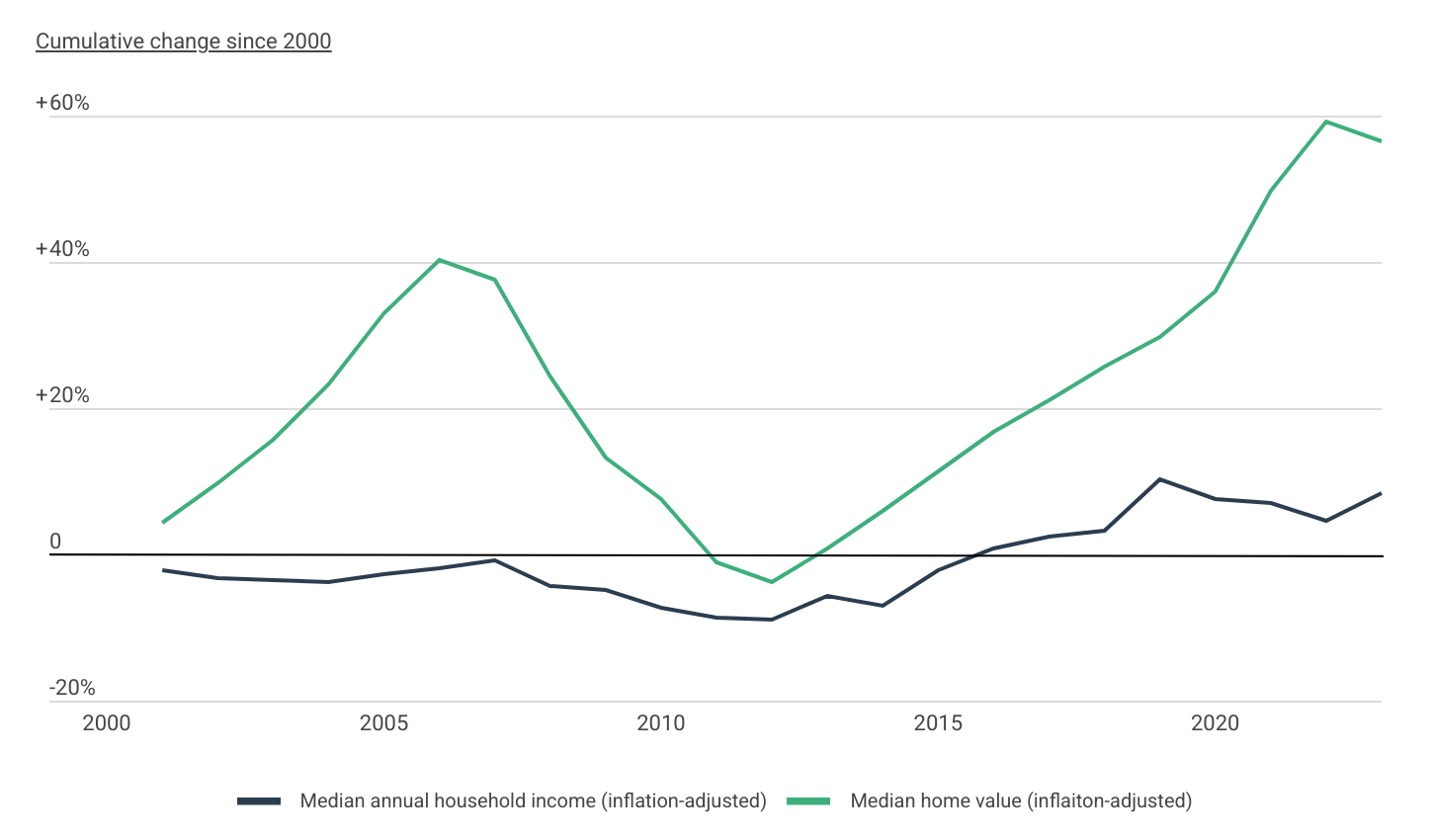

Changes in home prices have significantly outpaced income growth

Source: Construction Coverage analysis of Zillow, Census, and BLS data | Image Credit: Construction Coverage

Although recent market trends have presented significant challenges, the issue of housing affordability has persisted in the U.S. for decades. At the heart of the problem is the widening gap between rising home prices and comparatively stagnant household incomes. Between 2000 and 2023—the latest year with available data on median household income—median home prices surged by 56.5% after adjusting for inflation. In contrast, median household income increased by only 8.5% over the same period.

New Home Construction by Number of Bedrooms

Smaller-sized, starter home construction has been on a multi-decade decline

Source: Construction Coverage analysis of Census data | Image Credit: Construction Coverage

Supply has been another constraint for first-time homebuyers. The U.S. faces a shortage of housing overall, but builders are also building fewer of the smaller, more affordable homes they used to. One- or two-bedroom homes represented 24% of single-family homes built in the mid-1980s, but just 5% in 2023—the lowest level on record. Over the same span, the share of new homes with four or more bedrooms grew from 19% to 51%.

Regional Differences in the Availability of Starter Homes

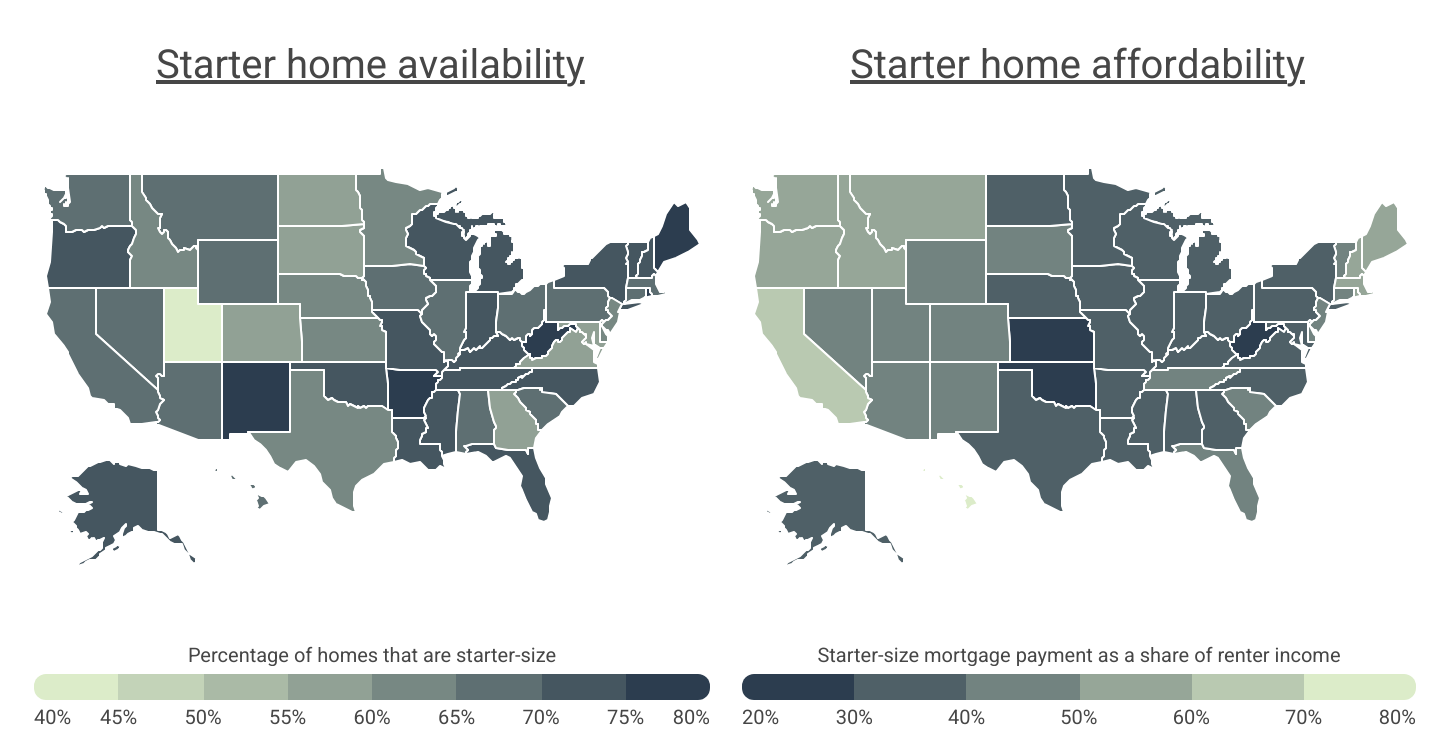

Starter-size homes are more common and more affordable in the eastern half of the U.S.

Source: Construction Coverage analysis of Zillow, Redfin, and Census data | Image Credit: Construction Coverage

The declining trend in the construction of starter-size homes—defined here as homes with three or fewer bedrooms—is especially apparent in the northern areas of the Great Plains and Mountain West. Less densely populated than their Northeast or West Coast counterparts, states in these regions all have a below-average share of starter-size homes (compared to the national average of 67.5%). Notably, Utah (42.2%) stands out with the lowest proportion of homes with three or fewer bedrooms, while Maine (76.8%) and New Mexico (76.0%) offer the greatest proportion of smaller homes.

Another important factor for new homebuyers is affordability. Nationally, the monthly mortgage payment for a typical starter-size home would consume 38.4% of the median income for renter households. In recent years, many of the most challenging real estate markets for first-time buyers have been concentrated in the western states, spanning the Mountain West, Pacific Coast, and Hawaii, all of which exhibit above-average mortgage costs relative to income.

Hawaii is the least affordable state for potential first-time buyers, with mortgage payments devouring 73.2% of the median income for renters. Hawaii is closely followed by California at 64.0%, making these states some of the worst for those seeking starter homes. At the opposite end of the spectrum, states in the Midwest and South, like Kansas (26.0%), Oklahoma (28.2%), and West Virginia (29.0%), provide buying opportunities that account for a much smaller share of income.

While conditions are challenging overall for new buyers, some parts of the U.S. are more favorable than others. To determine the best places to find a starter home in the U.S., researchers at Construction Coverage, a resource for contractors and construction industry professionals, calculated a composite score based on the percentage of homes with three or fewer bedrooms (40% of the score), the monthly starter-size home mortgage payment as a percentage of median renter income (20%), median sale price of homes with three or fewer bedrooms (15%), supply of homes (15%), and the homeownership rate for under-35 householders (10%).

By these measures, West Virginia is the best state in the country to find a starter home, followed by Mississippi and Oklahoma. Starter-size homes in these states represent over 70% of the total housing stock and are relatively affordable. Similar trends hold at the metropolitan level, with Southern and Rust Belt cities leading the way.

Here is a summary of the data for Alabama:

- Composite score: 63.6

- Percentage of homes that are starter-size: 69.3%

- Starter-size mortgage payment as a share of renter income: 35.6%

- Median price of starter-size homes: $213,702

- Months supply: 3.8

- Homeownership rate for under-35 householders: 42.0%

For reference, here are the statistics for the entire United States:

- Composite score: N/A

- Percentage of homes that are starter-size: 67.5%

- Starter-size mortgage payment as a share of renter income: 38.4%

- Median price of starter-size homes: $319,787

- Months supply: 3.1

- Homeownership rate for under-35 householders: 36.1%

For more information, a detailed methodology, and complete results, see The Best U.S. Cities to Find a Starter Home on Construction Coverage.